Finance Fact #25 – Korea’s Rice Currency

- Details

- Finance Facts

In ancient Korea, rice was once used as official currency. 🍚🇰🇷

The healthcare sector is undergoing significant transformations worldwide. These changes directly affect the cost and availability of health insurance. In this article, we explore recent trends, compare key statistics, and analyze the impact on consumers and insurers alike.

When inflation rises, the purchasing power of money falls. This creates an important question for savers: is it still smart to keep money in a traditional savings or deposit account?

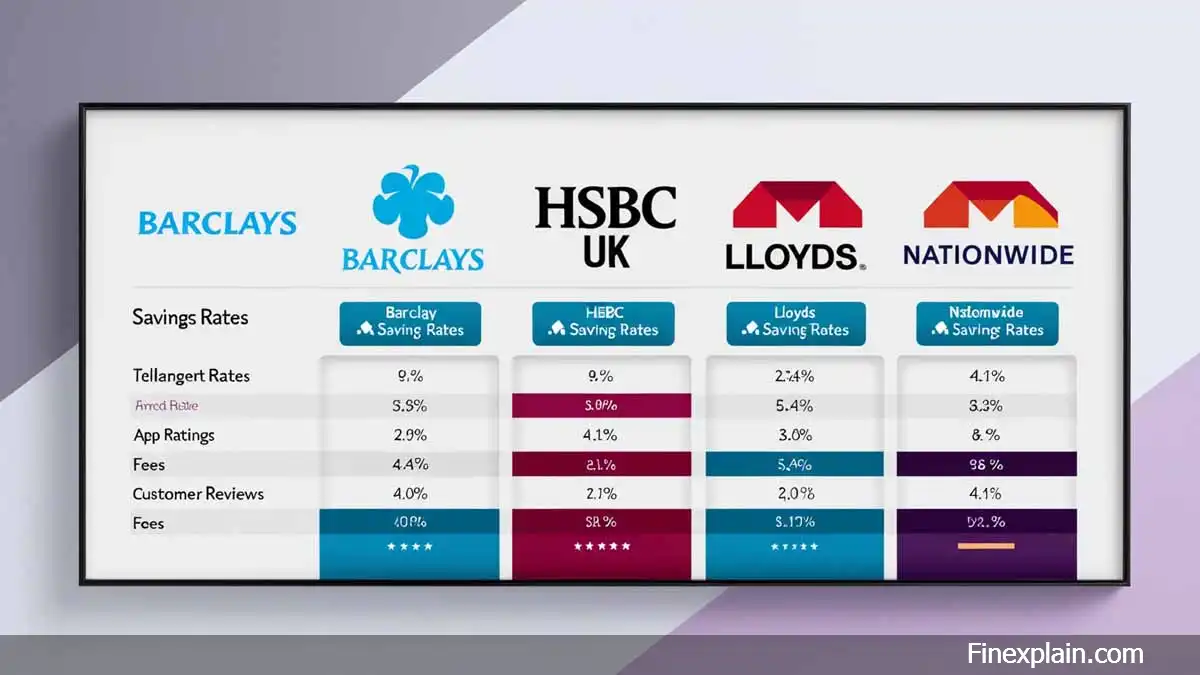

In today's complex finance landscape, it's crucial to explain the differences between major banking institutions to help British residents make informed decisions. This detailed comparison examines four leading banks — Barclays Bank, HSBC UK Bank, Lloyds Bank, and Nationwide Building Society — focusing on their services, fees, interest rates, and customer satisfaction metrics for 2024-2025.

Understanding how the global economy is divided between different regions can help us see where economic power is concentrated and how it may be shifting over time. This article explains the current structure of global GDP (Gross Domestic Product) using the most recent data from the World Bank.

The insurance industry is undergoing a major transformation. Artificial Intelligence (AI) and Big Data analytics are changing how insurance products are created, personalized, and priced. This article explores how these technologies are impacting risk assessment and customer experience.

When it comes to finance, understanding how your pension behaves during job changes or international moves is essential for long-term stability. In this article, we explain what happens to your retirement savings when your career or life crosses borders.

© Finexplain.com. All rights reserved. No copying without permission.